The Studio - Reykjavik

Paul Cottrell, Chaos theory, Economic Emergence, Black Swan, Economics, Developmental Economics, Behavioral Finance, Finance, complexity science, risk management, dynamic Hedging, computational finance

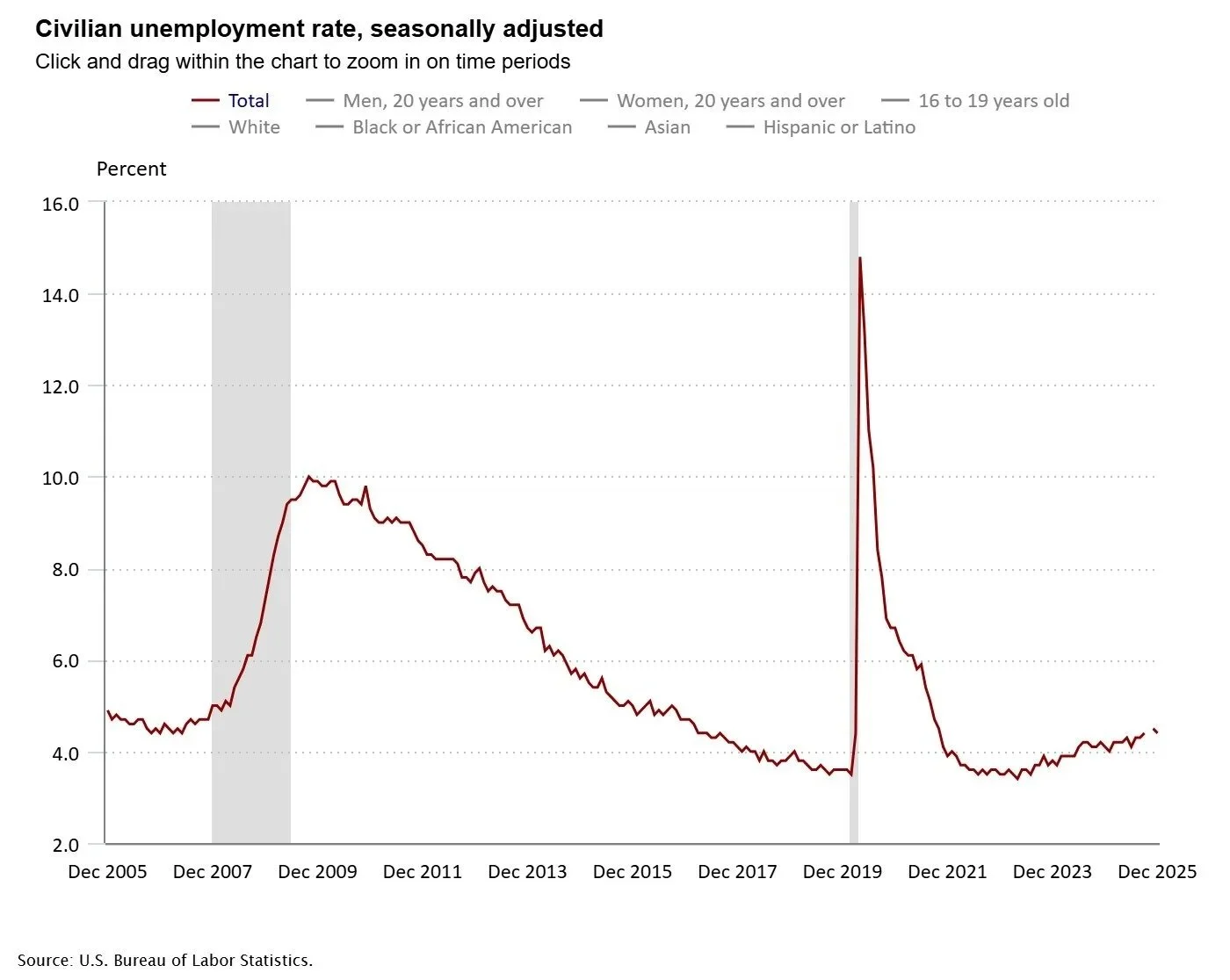

U.S. Labor Market Shows Mixed Signals as December Jobs Growth Slows, Unemployment Dips Slightly

The Studio - Reykjavik

Paul Cottrell, Chaos theory, Economic Emergence, Black Swan, Economics, Developmental Economics, Behavioral Finance, Finance, complexity science, risk management, dynamic Hedging, computational finance

The Studio is the abode of Paul Cottrell, a researcher in financial markets. The concept of The Studio is a textual, audio, and video exploration in economics, finance, and current events. This platform provides users of all kinds commentary, scholarly research, and applied computational finance models and code. The Studio is a culmination of various skill-sets that Paul Cottrell has obtained over many years - part engineer, part designer, and part financial market participant.

Dr. Paul Cottrell | 888 Main St, New York, NY, 10044, United States